Buying Midwestern Banks based on Price/Book ratio in 2024

As a followup to my previous article where we discovered that at least in 2024 the naive strategy of buying banks based solely on price to book ratio did not perform as advertised. However, the Value Line from which I drew my sample also treats Midwestern banks as a separate category of bank, for reasons knowable only to them. True, Midwestern banks are more likely to be small or medium sized and regional, but in my previous article I focused on similar non-Midwestern banks, as large investment or money center banks likely have a distinct competitive niche that makes them less susceptible to being examined purely on their balance sheets. Also, I found some repeat entries from last week in this set of banks, meaning that depending on when one looks a bank can simultaneously be Midwestern and not Midwestern.

For the non-Midwestern banks, recall, neither regression analysis nor the simple sorting into quadrants of above and below average indicated that this strategy showed any chances of outperforming. Nor were results noticeably different when using tangible book value, which at least implies that most banks are not sitting on overdue writeoffs of goodwill, which I suppose is promising.

But now focusing on Midwestern banks, using raw book value the naive strategy fared no better in 2024, with an r-squared value of 1.72%, which is entirely consistent with the relationship between price/book value and returns being nonexistent. And removing outliers resulted in no improvement, as three of the banks with a price/book ratio above 1.8 performed better than the average for all banks under consideration and two such banks underperformed.

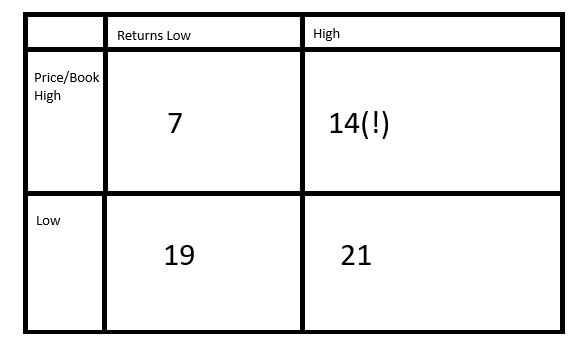

Looking at the quadrant approach, we see that in fact twice as many banks with an above average price to book ratio earned an above average return. So much for price/book ratio mattering! Low price to book was divided evenly.

However, when we switch to tangible book values, we see that the low price to book ratio strategy has some stirrings of validity. The r squared value was 2.75%, which is still quite small but considering how many factors actually go into bank returns, ferreting out the effect of a single causative factor is not easy and 2.75% is certainly further from zero than we’ve seen earlier.

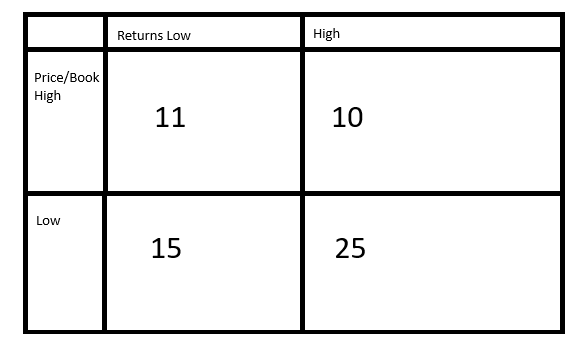

And looking at the quadrant we see dramatic results indeed. The apparent “advantage” in high price to book banks more or less disappears, and is replaced by an apparent advantage in low price to book banks. So this suggests, at least subtly, that for Midwestern banks some goodwill writeoffs are indeed overdue and that the effort banks go through to report tangible as well as raw book value is not wasted, at least in the Midwest.

Obviously, more years and more potential for confounding variables should be examined, but it is encouraging to see that our naive price to book strategy is not entirely off base. And we haven’t even started on insurance companies yet.

Leave a Reply