Should we care about the broader market

If you have been reading the financial news since about last May, journalists have been disturbingly preoccupied with the level of the indexes, and have been calling for, say, the S & P to correct from 900, as it sailed merrily past 1000 just to spite them. One imagines that they’ve been going for the stopped clock being right twice a day approach, and after yesterday, (Sept. 1), it seems very much as if they got their wish, at least for the moment.

Should a value investor care about the level of the broader market? Benjamin Graham himself counseled us that when the market is overvalued, even safe investments can be caught in the retreating tide. Warren Buffet, for his part, told his investment partnership in 1969 that nothing he knew how to do would make money in the present environment, so he was liquidating the partnership.

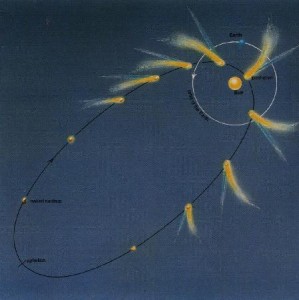

Obviously, when the market is in a depressed mood bargains are more likely to be available, but the central tenet of value investing is that a security’s price and value behave like a comet orbiting a star; they’re locked together as if by gravity but only on rare occasions are they close. However, it is the nature of all financial assets that they turn into cash sooner or later; for bonds, it’s not only sooner but according to schedule, for stocks, often but not always later because they are constantly selling, buying, and shuffling around assets.

Obviously, when the market is in a depressed mood bargains are more likely to be available, but the central tenet of value investing is that a security’s price and value behave like a comet orbiting a star; they’re locked together as if by gravity but only on rare occasions are they close. However, it is the nature of all financial assets that they turn into cash sooner or later; for bonds, it’s not only sooner but according to schedule, for stocks, often but not always later because they are constantly selling, buying, and shuffling around assets.

If an asset produces cash, now or later, it is worth the cash it produces, and if it does not produce the expected amount of cash it gets written down when that becomes apparent. No matter what happens, cash is always worth cash (although Damodaran, in Damodaran on Valuation, cited some studies to show that this is usually but not always the case). That said, our desire for high current and potential cash flow will insulate us from temporary disruptions in the market, and if our time horizon is shorter than the duration of these disruption, we should be invested in something other than securities.

This cash flow is why CMO, one of my earlier recommendations, has a floor built in to it. With the government explicitly guaranteeing all of its holdings, there is a frozen limit below which its price cannot go (which happens to be about $2 a share below its current price), and that is the present value of the cash it can produce, either from the mortgagors or from the government. If the price does drop below that limit, we can buy it literally without a second thought. Or even a first one.

So, is this yesterday’s action the start of a new leg down for the market, a correction, an event that enough people think is a correction that it will become a self-fulfilling prophecy, or just a coincidence? I don’t know, and whatever the answer is I’m not worried.

Leave a Reply