Skywest – Buy It For Its Cash Holdings, Keep It For Its Airline Business

Skywest (SKYW), a provider of regional flight services mainly to United Continental and Delta Airlines , has a balance sheet that I would describe as very interesting. The company literally has enough cash and securities on hand to buy back more than 80% of its shares. Skywest has a market cap of $793 million as of this writing, and its latest balance sheet shows $646 million in cash and marketable securities, which at first approximation implies that one could buy the company for its securities portfolio and get its entire future earnings stream for $150 million, which is less than the company earned in its last full year. In other words, removing Skywest’s excess cash and securities from the equation and valuing only the operating assets of the company gives us a P/E ratio of approximately one.

Unfortunately, that’s not quite how it works. Equity holders are at the end of a long list of prior claimants on a company’s assets, and Skywest has a significant amount of bank debt and also leases many of its planes. Therefore, the question becomes how likely it is that these liabilities will be met by Skywest’s future cash flows, so that the shareholders’ residual claim on the cash and securities is unlikely to be preempted.

As stated in Value Investing: From Graham to Buffett and Beyond, there are three sources of value for a company that roughly correspond to the past, the present, and the future. The balance sheet, where all of Skywest’s cash and securities exist, represents the past. The company’s earnings power as represented by its income statement is the present, and the company’s future growth prospects represents the future. The purpose of making this distinction is the varying degrees of reliability that the three sources have. The balance sheet is, barring accounting irregularities, reliable, although some figures need adjusting to reflect the realities of business. The recent income statements represent the present in that, although they require some insight as to whether the company can repeat the performance, the company has nonetheless established its present ability to produce these earnings and can to a degree be counted on to continue to produce them. The growth factor, representing the future, is the least reliable, first of all because the anticipated growth may not materialize, and second because, even if the growth does materialize, it is possible that the cost of the capital required to create the growth will equal or exceed the growth itself. The lesson, then, is to confine our investments to where the value proposition has the greatest reliability, ideally on the strength of the balance sheet alone. However, as those opportunities are rare nowadays, we should rely on the balance sheet and the current earnings power.

Turning back to Skywest, I believe that the levels of cash on the balance sheet are mostly safe over the long term. Skywest is cash flow positive from an operational standpoint, and although it has significant debt repayment obligations in future years, I find it plausible that the company will be able to roll over its debts. Furthermore, Skywest derives over 90% of its revenue from fixed-rate contracts, whereby its contracting partners, which are major airlines like United and Delta, pay the company a flat rate per flight-hour, modified by incentive bonuses or penalties. Furthermore, its partners reimburse Skywest for the cost of fuel and other expenses. This insulates Skywest from the two largest sources in earnings volatility that affect airlines: ticket prices and volumes and fuel prices. As a result, margins for Skywest can be expected to be more stable than those of most airlines, thus lowering the risk of substantial negative operating cash flows for a long period.

Skywest runs approximately 4000 flights per day for short-haul flights between smaller regional airports and the major hubs, in airplanes that typically have a seating capacity of 70 or less. The terms of their contracts allow Skywest to use the airline codes and plane decals of its contracting partners. Skywest’s partners also handle the booking and, as stated above, reimburse Skywest for fuel and some other expenses, sometimes including wear and tear on planes. Nearly 2/3 of Skywest’s flights arise from a contract with United, and nearly 1/3 with Delta, with the balance made up by US Airways, American, and Alaska. Skywest’s contracts with these airlines typically run for five or more years.

Skywest runs approximately 4000 flights per day for short-haul flights between smaller regional airports and the major hubs, in airplanes that typically have a seating capacity of 70 or less. The terms of their contracts allow Skywest to use the airline codes and plane decals of its contracting partners. Skywest’s partners also handle the booking and, as stated above, reimburse Skywest for fuel and some other expenses, sometimes including wear and tear on planes. Nearly 2/3 of Skywest’s flights arise from a contract with United, and nearly 1/3 with Delta, with the balance made up by US Airways, American, and Alaska. Skywest’s contracts with these airlines typically run for five or more years.

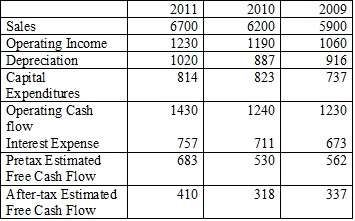

Turning now to the figures, sales in 2012 were $3.534 billion, and reported operating earnings was $166 million. Depreciation and amortization were $252 million and net capital expenditures were $58 million, producing operating cash flows of $360 million. Net interest expense was $69 million, leaving $291 million in pre-tax cash flow, or $257 million after estimated income taxes at a 35% rate.

In 2011 sales were $3.655 billion, operating cash flow was $116 million, and estimated after-tax cash flow was $53 million. In 2010 sales were $2.765 billion, operating cash flow was $270 million, and estimated after-tax cash flow was $149 million.

After-tax free cash flow assumes a 35% income tax rate and that excess depreciation is not taxable. It is also calculated before net debt repayments.

The first half of 2013 is shaping up well. Operating earnings are comparable to those of the first half of 2012, although capital expenditures have increased to be more in line with historical levels. However, I should add that Skywest has recently been expanding its capacity, disposing of some of the smaller and more marginally profitable aircraft in its fleet and taking on larger ones, and also increasing its total number of flight hours by 3-6% on a year-over-year basis, so at least some of the additional capital expenditures for 2013 as compared to 2012 may be considered growth capital, i.e. expenditures intended to increase earnings power rather than simply to maintain it.

Thus far, sales in 2013 were $1.643 billion versus $1.858 billion for 2012, capital expenditures were $85 million versus $40 million, operating cash flows were $103 million versus $155 million, and estimated after-tax free cash flow was $58 million as compared to $109 million. Again, after-tax free cash flow assumes a 35% income tax rate and that excess depreciation is not taxable. It is also calculated before net debt repayments.

I should also point out that Skywest’s accounting policy is to record its fuel reimbursements as revenue, so although operating earnings are unaffected, this policy has an affect on the comparability of sales over differing periods.

I alluded earlier to the fact that Skywest leases many of its airplanes. Rental payments for Skywest come to roughly $330 million per year. Furthermore, the terms of Skywest’s loans requires them to make principal repayments of roughly $180 million per year for the next four or five years. However, maintaining this debt payment schedule would reduce Skywest’s level of long-term debt to barely a fifth of its historical level, and as debt repayments tend to produce a corresponding increase in borrowing capacity it should be entirely possible for Skywest to roll over its debts at least in part. Also, based on my research, Skywest’s level of total fixed charge coverage is comparable to those of its competitors, most of which do not enjoy the stability of margins that Skywest gains from its fixed-fee contracts.

Furthermore, although most airline companies maintain a large holding of cash and securities in order to maintain a cushion against the cyclicality of the airline industry, Skywest is unique among airlines in that its portfolio represents such a large percentage (over 80%) of its current market cap, and this despite its fixed-fee contracts providing significant insulation from the effects of cyclicality as well.

So, if Skywest’s performance remains on its current course, the company’s cash flow generation should be sufficient to leave its portfolio of cash and securities at its current level, while any future expansion of the company is also the shareholders’ to enjoy. At the same time, the portfolio should provide substantial protection from any downside moves as so much of the company’s value comes from financial assets already in place rather than uncertain future cash flows. Therefore, I can strongly recommend Skywest as a candidate for portfolio inclusion.